Location of earthquake epicenter: 7 miles east of Luther, Oklahoma.

It is about 300 miles from Botkinburg, Arkansas to Luther, Oklahoma.

screenshot of http://www.huffingtonpost.com/2013/04/10/arkansas-tornado-april-2012_n_3057686.html

How long before these severe weather conditions blow over?

Is there a generality that Oklahoma, Arkansas, and surrounding region, including regions in Alabama, Mississippi, and Missouri, need to be prepared for both types of events, earthquakes and tornadoes, and might as well include hurricanes, over the next few weeks?

Do some folks that live in houses that are not very stable in terms of their construction, and, or, are way out in rural areas, if they have not already, might have increased safety if they were to collect their needed belongings, and head to a region not as turbulent for a couple of weeks?

Are there temporary emergency bunkers built in those regions in case earthquakes/tornadoes/hurricanes hit again in the next few days?

Tornado conditions additionally affected Mississippi, Missouri, and Alabama last week, causing damage.

|

| original map before diagram courtesy Google maps; click for larger view |

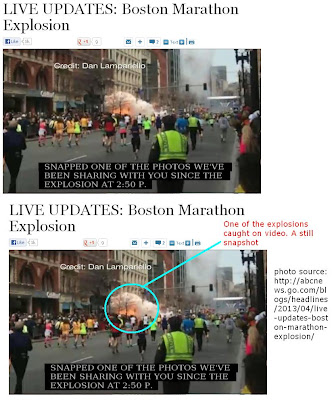

On the Boston Marathon tragedy yesterday.

It is wonderful that there is an outpouring of emotional support, YouTube postings, etc.; at the same time, the rates of abducted/ kidnapped/ abused children, averaged even on a daily basis is startling; no matter what happens, it is important that this aspect of safety be maintained.